How the Process Works

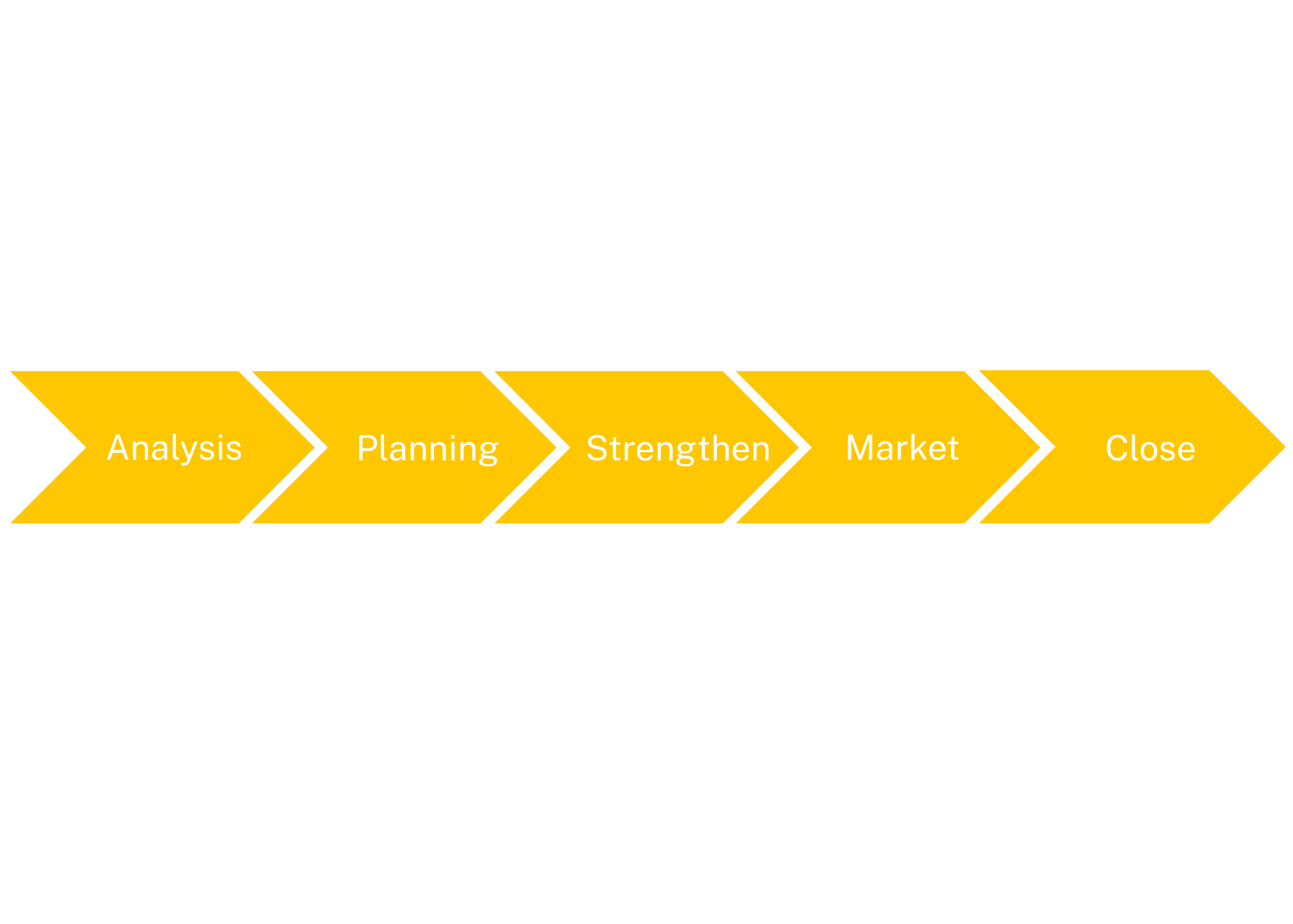

The Value Prep Process follows five deliberate stages, each designed to strengthen value and protect outcomes.

Skipping stages doesn’t save time—it costs money.

1. Analysis:

See Your Business the Way Buyers Do

Every engagement begins with a disciplined assessment of readiness. We prove a free valuation and analysis to evaluate the business through a buyer’s lens to identify gaps, risks, and friction points that will impact valuation, deal structure, or certainty of close.

This stage focuses on:

Financial clarity and credibility

Operational risk and documentation

Owner dependency and management depth

Customer, revenue, and concentration risk

Diligence readiness

Outcome:

A clear understanding of what will help—or hurt—your value in a sale.

2. Planning:

Determine What Buyers Pay For

Once risks and gaps are identified, we develop a clear, prioritized plan to enhance value. Not every improvement matters equally. Buyers reward specific value drivers—and penalize specific risks.

This stage focuses on:

Strengthening core value drivers

Reducing perceived and actual risk

Improving sustainability and scalability

Aligning operations with buyer expectations

Sequencing improvements by impact and effort

Outcome:

A practical roadmap that improves value without unnecessary complexity.

3. Strengthen:

Turn Performance into a Defensible Story

Valuation is not just math—it’s interpretation. Strong positioning aligns financial performance with a clear, credible narrative that buyers can understand, trust, and justify.

This stage focuses on:

Establishing a defensible valuation framework

Identifying the right valuation metrics

Framing strengths in buyer-relevant terms

Supporting valuation with evidence, not optimism

Preparing the business for buyer scrutiny

Outcome:

A valuation and narrative that withstands diligence and negotiation.

4. Market Preparation & Buyer Strategy:

Control the Process Before Buyers Control You

Preparation extends beyond the business itself. We prepare how the business is introduced to the market, who sees it, and how information flows.

This stage focuses on:

Buyer targeting and strategy

Confidential market preparation

Information structuring and presentation

Managing buyer expectations early

Protecting leverage through process control

Outcome:

A controlled, strategic go-to-market approach that attracts the right buyers.

5. Deal Execution & Close:

Protect Value Through the Finish Line

Many deals lose value during execution—not because of lack of interest, but due to poor control during negotiation and diligence. We manage execution with discipline to ensure value created earlier is not given back at the table.

This stage focuses on:

Offer evaluation and deal structure

LOI negotiation

Diligence coordination and issue management

Maintaining momentum and leverage

Closing with certainty

Outcome:

A transaction that reflects the true value of the business—not last-minute concessions.

A Disciplined Framework for Maximizing Business Sale Value

Most business owners believe value is determined when the business goes to market.

In reality, value is determined long before that by how prepared, positioned, and de-risked the business is when buyers begin their evaluation.

The Value Prep Process is our structured advisory framework designed to help owners increase value, reduce deal risk, and maintain leverage throughout a sale process.